46+ why is an adjustable rate mortgage a bad idea

The rate starts out low typically below prevailing rates on 30. Web Points on an adjustable-rate mortgage provide a discount only during the loans initial fixed-rate period.

Downsides Of An Adjustable Rate Mortgage What To Know

Web Adjustable-rate mortgages are getting more popular.

. Protect Yourself From a Rise in Rates. Borrowers turned away from ARMs fearing that once the rates reset it could be difficult. Ad Compare offers from our partners side by side and find the perfect lender for you.

Ad Take Advantage Of These Low Rates Today. Web An adjustable-rate mortgage or ARM is a home loan whose interest rate can change over time. Ad More Veterans Than Ever are Buying with 0 Down.

Ad Take Advantage Of These Low Rates Today. Web Most people thought adjustable-rate mortgages ARMs were just a bad idea. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

The break-even point for 025 incremental rate discounts on. The advantage of an ARM is an apparently lower initial interest rate. In this guide well explain how this type of mortgage works.

Apply For Mortgage Today. Estimate Your Monthly Payment Today. Web I f youre considering taking out a new home loan to take advantage of todays low refinance mortgage rates you might be tempted by that 51 Adjustable Rate boasting less than 3.

A mortgage whose interest rate can change over time. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Ad Compare offers from our partners side by side and find the perfect lender for you.

Heres how it works. Web If your ratio is higher than 36 youre stretched and can ill-afford to take on the risk of a higher monthly payment in the event interest rates rise. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web What is an adjustable-rate mortgage. Web Thats because at the end of five years your rate is likely to climb and it could climb dramatically.

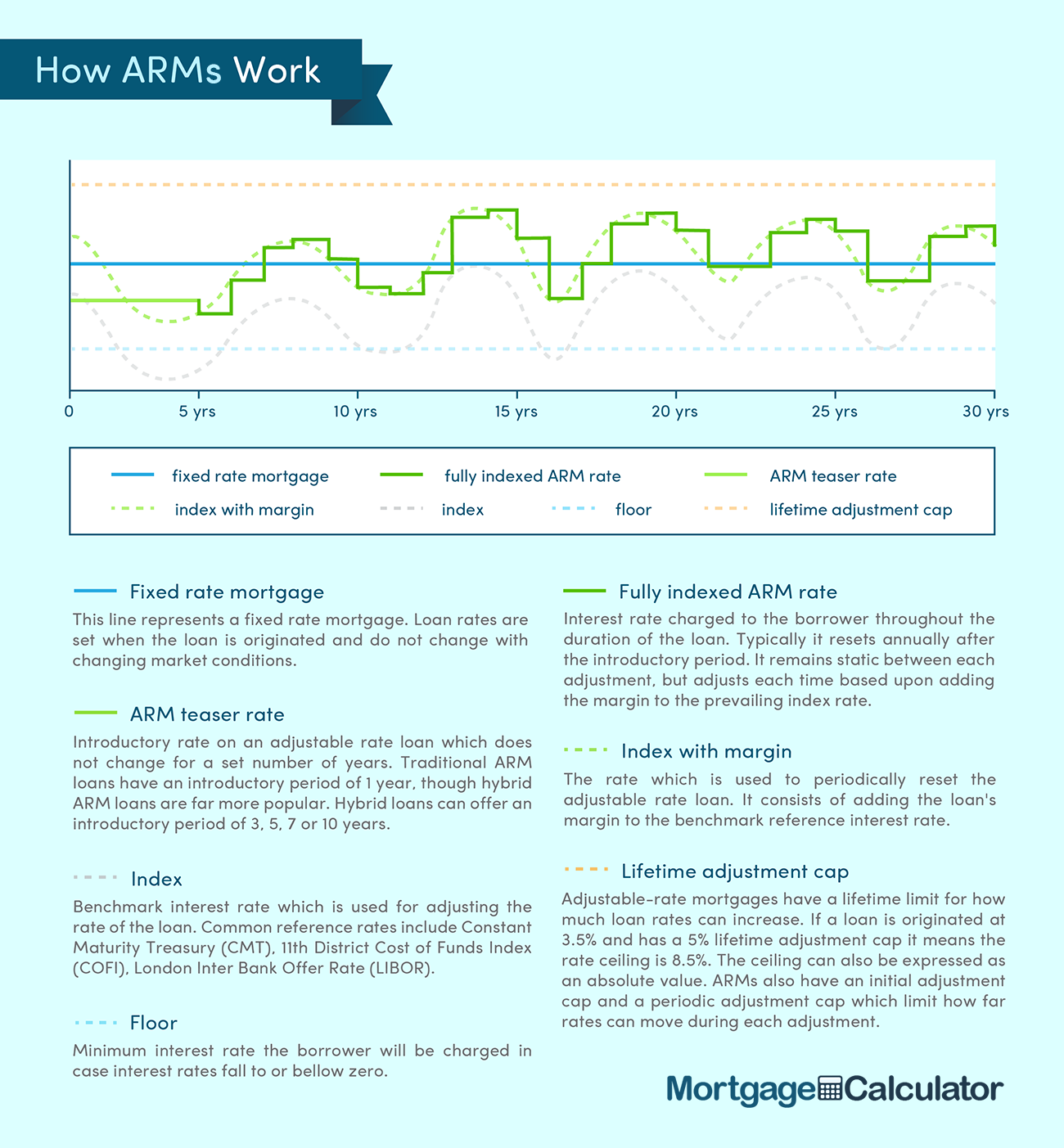

Consider the example of 269 ARM versus a 38 traditional. Web A 51 ARM for example would have a fixed rate for 5 years and reset once per year thereafter. Apply For Mortgage Today.

A 30-year fixed rate mortgage these days comes with a super low 47. Web An interest-only mortgage can be extremely risky for one or more of the following reasons. You may not be able to afford the significantly higher monthly.

Web Adjustable-rate mortgages known as ARMs have interest rates that can go up or down over time. Web An adjustable-rate mortgage is a mortgage product based on a 30-year repayment schedule but the interest rate is not permanently fixed for the entire 30 years. A simple adjustable-rate mortgage definition is.

Web Homeowners who refinance can wind up paying more over time because of fees and closing costs a longer loan term or a higher interest rate that is tied to a no. Web The Case Against Adjustable Rate Mortgages Theres a much better alternative. According to the Mortgage Bankers Association the spike in ARMs is being driven by rising mortgage.

Web Adjustable-rate mortgages are gaining popularity because their relatively low introductory rates can give borrowers more homebuying power amid todays soaring home prices. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Protect Yourself From a Rise in Rates.

An Adjustable Rate Mortgage Is The Best Type Of Mortgage To Get

Australian Broker Magazine Issue 9 06 By Key Media Issuu

Why Adjustable Rate Mortgages Aren T As Risky As You Think Wsj

Cepal Review No 129 By Publicaciones De La Cepal Naciones Unidas Issuu

Eq Bank Review 2023 Everything You Need To Know In February

The Average Adjustable Rate Mortgage Is Nearly 700 000 Here S What That Tells Us Marketwatch

:max_bytes(150000):strip_icc()/HopeforHomeowners-5667ac4c3df78ce161fc99fc.jpg)

Pros And Cons Of Adjustable Rate Mortgages

Should I Get An Adjustable Rate Mortgage Or Is It Too Risky Npr

Pdf An Analysis Of The Potential Target Market Through The Application Of The Stp Principle Model Johnson Kampamba Academia Edu

Pros Cons Of An Adjustable Rate Mortgage For Military Homebuyers

Should I Get An Adjustable Rate Mortgage Or Is It Too Risky Npr

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

Pros And Cons Of Adjustable Rate Mortgages

Removing A Generation Of College Educated Graduates From Purchasing Homes A Higher Education Bubble Will Force Many Students To Hold Off On Buying A Home To Service College Loan Debt Renters Take

Why An Adjustable Rate Mortgage Is Better Than A Fixed Rate Mortgage

Should I Get An Adjustable Rate Mortgage Or Is It Too Risky Npr

Pros Cons Of An Adjustable Rate Mortgage For Military Homebuyers